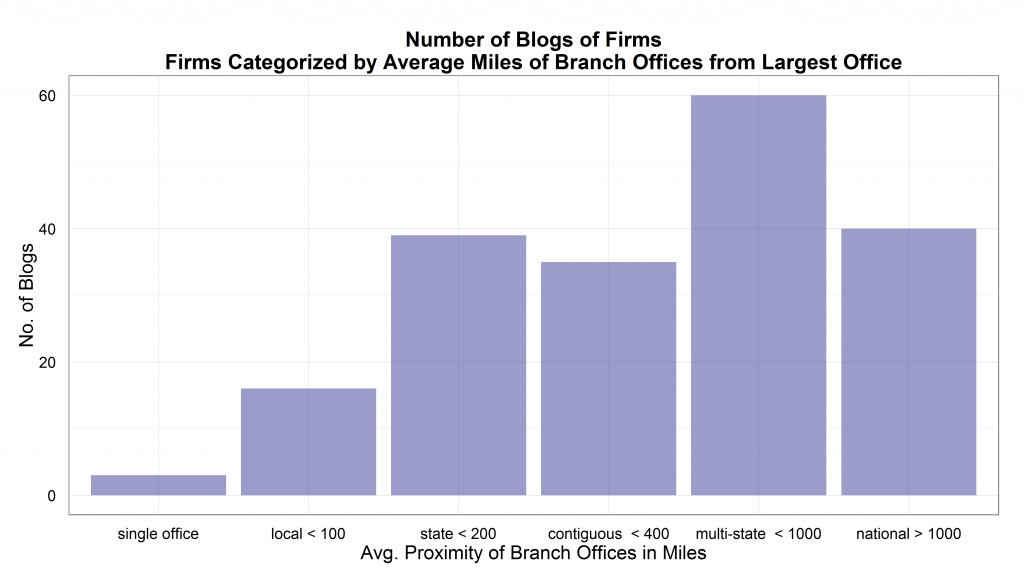

Continuing this series on law firms and their blogs, I hypothesized that firms with wider-spread branch offices would support more blogs. My reasoning was that if your footprint of clientele and prospective clients is broad, you need marketing efforts that reach broadly. Prospective clients everywhere can read blogs so they inherently reach broadly. On the other hand, firms whose offices are clustered more around their largest office may rely relatively more on local marketing.

The plot below shows the total number of blogs hosted by groups of firms where the firms are categorized by different average distances of their branch offices from their main office.

Single office firms are on the left side of the horizontal X-axis and the short column tells us that they host only 2or 3 blogs. What I termed “local” firms have an average distance of their branch offices from their main office of less than 100 miles: “local < 100”. As a group they hosted 17 blogs. “State” firms have an average distance of their branch offices at less than 200 miles, so I thought of them, roughly speaking, as covering one state. If the average of the firm’s branch offices was between 200 miles and 400 miles, the firm was categorized as “contiguous” since their offices were likely clustered in their home state and bordering states. The category “multi-state < 1000” suggests firms that have established branch offices beyond bordering states, but perhaps not spanning the country, which is what the category “national” firms represents.

Law Department Management Blog

Law Department Management Blog